The Harbor Capital Appreciation Fund (HACAX) has consistently been recognized as one of the best-performing large-cap growth funds in recent years. In 2023, the fund was named one of the Best Stock Funds by the Wall Street Journal, highlighting its exceptional performance and investment strategy.

TRENDING

Cashing In: The Benefits of Money For Junk Cars

Investment Philosophy and Approach

The Harbor Capital Appreciation Fund’s investment philosophy emphasizes long-term growth, focusing on disruptive technologies, new product cycles, and expanding markets. The fund’s management team, led by subadvisor Jennison Associates, employs a bottom-up, fundamental research approach to identify companies with strong management, high barriers to entry, and the potential for above-average earnings growth.The fund invests primarily in equity securities of U.S. companies with market capitalizations of at least $1 billion at the time of purchase. The portfolio is diversified across sectors, with a focus on companies that can innovate, invest, and grow through variable macroeconomic environments.

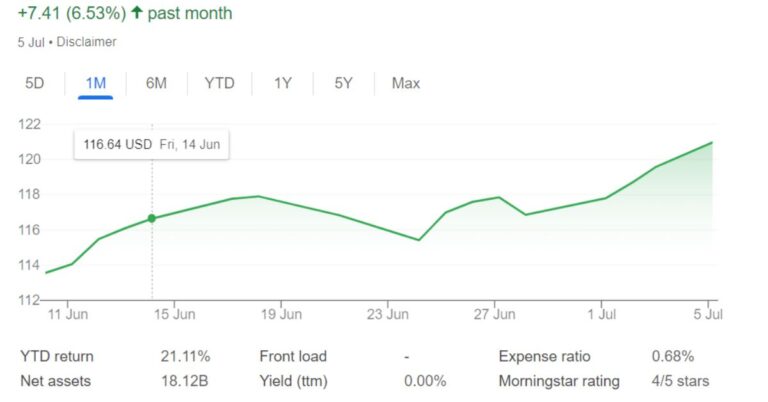

Performance and Benchmarks

The Harbor Capital Appreciation Fund has consistently outperformed its benchmarks, the Russell 1000® Growth Index and the S&P 500 Index, over the long term. In the third quarter of 2023, the fund returned -3.38%, slightly underperforming its benchmarks, which returned -3.13% and -3.27%, respectively.Despite the short-term underperformance, the fund’s management team remains confident in the long-term growth potential of the portfolio holdings. The team believes that the fund’s focus on companies with the ability to innovate and grow through various economic conditions will support its ability to generate above-average returns over time.

Notable Holdings and Contributors

The Harbor Capital Appreciation Fund’s portfolio includes a mix of well-established companies and innovative disruptors. Some notable holdings and contributors to the fund’s performance include:

- Eli Lilly: The pharmaceutical company contributed positively to returns during the third quarter of 2023, benefiting from exceptionally strong sales in its diabetes and obesity drug Mounjaro and improving reimbursement trends.

- Alphabet: The parent company of Google has seen stabilization of advertising demand and accelerating growth in its search and YouTube segments, contributing to the fund’s performance.

- Apple: Despite underperforming in a weak market for growth stocks, Apple continues to demonstrate the power of its ecosystem, which includes two billion iPhones. The fund’s management team views Apple as a consistent compounder with a track record for delivering growth, even in difficult operating environments.

- Microsoft: The software giant underperformed in a weak market but continued to gain share across multiple product lines. Microsoft is also well-positioned for the artificial intelligence (AI) wave as the concept transitions to reality.

Recent Developments and Initiatives

In addition to its strong performance, the Harbor Capital Appreciation Fund has been recognized for its achievements and has been involved in several recent developments and initiatives:

- Jennison Associates, the fund’s subadvisor, was named “2021 Large Cap Equity Manager of the Year” by Envestnet, in partnership with Investment Advisor Magazine.

- The Harbor Capital Appreciation Fund was included in Kiplinger’s profile of the top mutual funds in 401(k) retirement plans in 2021 and 2022.

- Harbor Capital Advisors, the parent company of the Harbor Capital Appreciation Fund, has been expanding its product offerings, launching new ETFs focused on corporate culture, inflation, and long-term growth.

Conclusion

The Harbor Capital Appreciation Fund has established itself as a standout in the large-cap growth category, delivering consistent outperformance over its benchmarks and providing investors with exposure to innovative companies poised for long-term growth. With a strong investment team, a disciplined investment process, and a focus on disruptive technologies and expanding markets, the fund is well-positioned to continue its success in the years to come.

ALSO READ: How Much Do French Bulldogs Cost?