Zimbabwe dollar to USD—a phrase that has come to symbolize more than just an exchange rate. It reflects the financial turbulence, public uncertainty, and persistent inflation that have plagued Zimbabwe’s economy for decades. From trillion-dollar banknotes to the introduction of a gold-backed currency known as ZiG, Zimbabwe has seen one monetary experiment after another.

But despite these efforts, trust in local currency remains elusive. In this article, we explore how the Zimbabwe dollar to USD conversion affects everyday life, why the new ZiG currency was introduced, and whether Zimbabwe can finally break free from its cycle of economic instability.

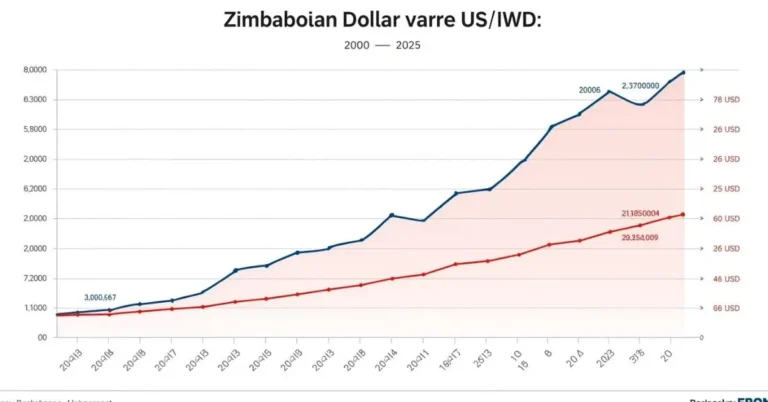

Complete Fluctuation Details of zimbabwe Dollar to USD from 2015 to 2025:

| Year | Currency Type | Exchange Rate (≈ 1 USD =) | Notes |

| 2015 | ZWL (RTGS/bond notes era) | ~322 ZWL | Relatively stable under multi-currency system |

| 2016–2018 | ZWL | ~322 ZWL (official) | Rate frozen, pegged at about 322 |

| 2019 | ZWL (official) | ~322 ZWL | RTGS dollar rebranded as ZWL; used alongside USD |

| 2020 | ZWL + USD (parallel) | ~322 ZWL | Multi-currency, USD used informally |

| 2021–2023 | ZWL + USD | ~1,000 ZWL/day by 2025 avg., soared | Rapid depreciation; 2023 average ~1,000 ZWL per USD |

| April 2024 | ZiG (introduced) | 13.56 ZiG | Launched April 5 backed by gold reserves |

| Oct 2024 | ZiG (official & black) | 27 ZiG official; ~50 ZiG black market | ZiG halved in official markets, worse privately |

| July 2025 | ZiG | ~26.84 ZiG | Current market rate with mild decline |

A Short History of Zimbabwe’s Monetary Chaos

Zimbabwe once had a thriving economy, but the early 2000s marked the beginning of an economic downward spiral. Poor governance, land reforms, sanctions, and hyperinflation all led to the complete collapse of the local currency. At the height of the crisis in 2008, the Zimbabwean dollar became so worthless that the government issued 100 trillion dollar notes.

To curb the crisis, the government adopted a multi-currency system in 2009—anchored by the US dollar. This move provided temporary relief and stability. However, political pressures led to repeated attempts to reintroduce local currency, each one failing against the rising value of the Zimbabwe dollar to USD.

Why Zimbabwe Keeps Changing Its Currency

Since 2009, Zimbabwe has rolled out several different forms of currency, including:

- Bond Notes (2016)

- RTGS Dollar (2019)

- ZWL (Zimbabwean Dollar) (2019)

- ZiG (Zimbabwe Gold) (2024)

Each rollout was followed by depreciation, leading to public distrust. The exchange rate between the Zimbabwe dollar to USD often worsened just weeks after introducing each new form of money.

What is ZiG and Why Was It Introduced?

In April 2024, the Reserve Bank of Zimbabwe launched a new currency called ZiG, short for Zimbabwe Gold. This currency is backed by gold and US dollar reserves, unlike its predecessors. Authorities initially pegged the rate at 1 USD = 13 ZiG and claimed that the new notes had modern anti-counterfeit security features.

The goal? To reduce dependence on the USD and finally stabilize the Zimbabwe dollar to USD conversion rate.

“This currency is meant to restore confidence in the financial system,” said a central bank official at the launch of ZiG.

Problems with ZiG: Why It’s Not Working (Yet)

Despite the fanfare, things quickly fell apart. Within a month, the ZiG had depreciated, and the Zimbabwe dollar to USD rate dropped to around 1 USD = 50 ZiG.

People are skeptical for several reasons:

- Zimbabwe has changed currencies too often.

- Inflation is still high.

- Many essential goods and services are priced in USD.

“I don’t trust any new currency,” says Epiphania, a retired nurse. “We’ve lost everything too many times.”

Public Response: Dollar Still Rules

Small business owners, workers, and students continue to rely on the US dollar.

Melissa, a shopkeeper in Harare, says:

“I only accept dollars in my shop. ZiG loses value too quickly.”

Tatenda, an 18-year-old student, adds:

“I save in USD and pay my transport fare in dollars. People refuse to give change in ZiG.”

Such testimonials illustrate the dominant preference for the USD and explain why the Zimbabwe dollar to USD relationship remains critical to understanding the local economy.

Zimbabwe Dollar to USD: Side-by-Side Comparison

Here’s how the US dollar and ZiG compare across multiple factors:

| Feature | US Dollar (USD) | ZiG (Zimbabwe Gold) |

| Stability | High | Low |

| Global Acceptance | Yes | No |

| Ease of Use | Widely accepted | Limited usage |

| Value Retention | Strong | Weak |

| Exchange Rate Reliability | Consistent | Fluctuating |

It’s clear why the Zimbabwe dollar to USD exchange remains heavily in favor of the USD in all day-to-day transactions.

Economic Challenges Behind Currency Instability

Dual Currency System

The government accepts taxes and fees in USD while promoting ZiG for daily use. This dual system causes confusion and reduces confidence in the local currency.

Informal Sector Resistance

Nearly 60% of Zimbabwe’s economy is informal. Vendors, transporters, and freelancers avoid ZiG because of fluctuating rates. Instead, they prefer stable foreign currency.

Debt Burden

Zimbabwe has defaulted on numerous foreign loans. A weak global credit rating further undermines the Zimbabwe dollar to USD trust factor among investors.

Why the Zimbabwe Dollar to USD Rate Matters

The Zimbabwe dollar to USD exchange rate is more than just a number. It affects:

- Grocery Prices: Shops raise prices in ZiG daily.

- Rent & School Fees: Landlords and schools demand payment in USD.

- Transport: Drivers quote fares in USD and refuse ZiG.

This makes life especially hard for citizens earning salaries in the local currency.

Recommendations by Financial Experts

Many economists believe the government must:

- Be transparent about gold and USD reserves

- Let the market determine exchange rates

- Encourage dollar deposits with secure banking

- Improve foreign relations and clear existing debts

- Invest in digital finance infrastructure

“Without trust, no currency reform will work,” says Professor Leonard Chiremba, a monetary policy expert based in Harare.

Digital Money: Can It Bridge the Gap?

The government has begun testing digital wallets and mobile payments to boost ZiG adoption. But issues like unreliable internet, power outages, and cyber security risks make implementation difficult.

Additionally, many people avoid banks, fearing government seizure or ZiG depreciation—making the Zimbabwe dollar to USD debate even more critical in digital spaces.

Conclusion

The Zimbabwe dollar to USD exchange rate tells a deeper story of broken trust, failed reforms, and an economy still struggling to find solid ground. From the devastating days of hyperinflation to the repeated rollout of new currencies like the latest gold-backed ZiG, Zimbabwe’s monetary path has been one of instability and public skepticism.

Despite government promises, the ZiG is already losing value, and citizens continue to rely heavily on the US dollar for security and survival. Without meaningful economic reforms, financial transparency, and a sincere effort to rebuild confidence, Zimbabwe’s dream of a strong local currency may never materialize. The world watches closely—but for Zimbabweans, this is more than economics; it’s their daily reality.

FAQs

What does the term “Zimbabwe dollar to USD” mean?

It refers to the exchange rate between Zimbabwe’s local currency and the US dollar, indicating how many ZiG you need to buy one USD.

Why is the US dollar preferred in Zimbabwe?

The USD is stable, accepted internationally, and maintains its value, unlike the ZiG which frequently loses worth.

Is ZiG backed by gold?

Yes, the government claims that ZiG is backed by gold and foreign currency reserves.

Can I use ZiG for international payments?

No, ZiG is not accepted outside Zimbabwe. International transactions require USD or other global currencies.

Has the ZiG succeeded in controlling inflation?

Not yet. ZiG’s value has already dropped since its launch, continuing the trend of unstable currencies.

What is the safest currency to hold in Zimbabwe?

Most citizens and businesses consider the US dollar the safest and most reliable currency for saving and transactions.